With a car lease you are paying for the use of that car for a set period of time; typically, 2, 3 or 4 years. You are paying for the depreciation only of the vehicle, thus getting the right lease deal can mean you can drive a much more expensive car for your budget than other methods of funding.

How Vehicle Residuals Effect Lease Payments

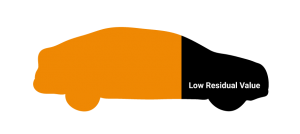

When you lease a new vehicle, you’re “buying” the vehicle’s depreciation (the left section).

When the residual value is high, you “buy” a smaller chunk of the car.

If the residual value is low, you have to buy a bigger portion of the car and that makes your lease payment higher.

Taking a car lease helps you avoid any unexpected costs by having a fixed monthly cost for the duration of the lease. You don’t have to worry about depreciation or selling the car as the finance company has responsibility for this. By adding an optional maintenance package on, any servicing costs and replacement tyres can also be covered,

The length of contract you choose can be down to how long you want to take the car for or sometimes can be due to there being a special offer on a particular length of contract (sometimes 2 year deals may work much cheaper than 3 years for instance due to the large discount on the vehicle being divided by a shorter timeframe)

Most car leasing deals consist of an ‘initial rental’ and a set series of monthly repayments. The initial rental refers to how much you’ll pay up front (usually after delivery) and is usually three, six or nine times the monthly payment amount. Car leasing deals are usually referred to by the size of the initial rental and the number of subsequent monthly payments. For example, a 6 + 35 agreement requires an initial rental amount equal to six monthly payments, after which you’ll pay a set monthly payment amount every month for the next 35 months. The total length of a 6 + 35 deal is 36 months (three years). A 9+23 would therefore be an initial rental of 9 payments followed by 23 monthly payments. There is usually a processing fee to be paid just after ordering.

No – the finance company buy the car and own it

As such, it’s quite similar to renting a house – you have sole use of it, but it’s still owned by the landlord at all times. If you want to change your car every few years and have a security of a new car under full warranty then leasing could be for you. If you want to own a car outright and run it for a long time then leasing isn’t really for you.

Not owning your leased car means you won’t have to worry about the hassle of selling it on, or how much it may have lost in value (depreciated) in the time you’ve been driving it. Our lease offers are on new cars only (some are pre registered but are brand new). As such they are all covered by the manufacturer’s warranty, meaning you won’t have to pay to fix any unforeseen issues.

Just the same way you would for a car you owned outright. On the bulk of our offers we can’t factor it in to the rental so you will need to arrange fully comprehensive insurance. When insuring, you have to put the finance company as owner and keeper of the car. Sometimes as the car is brand new, the registration number won’t show on their database so you will have to give them make and model and explain it is brand new in order to get a quote.

Car leases can be expensive to get out of if your circumstance change- there will be a settlement based around the number of rentals left. You should always consider if you can keep up repayments if your circumstances were to change.

Check our other informative pages:

Guide to personal leasing

Guide to Business leasing

FAQ’s

Maintenance explained

Don’t worry, simply request a call back and one of our friendly advisors will contact you at a time which best suits you.

Enquire TodayRegister today for latest special offers ££££